Protect Your Small Business From The IRS

Survive and Thrive with SMALL BUSINESS KICKSTARTER

IRS Targets Small Business Owners

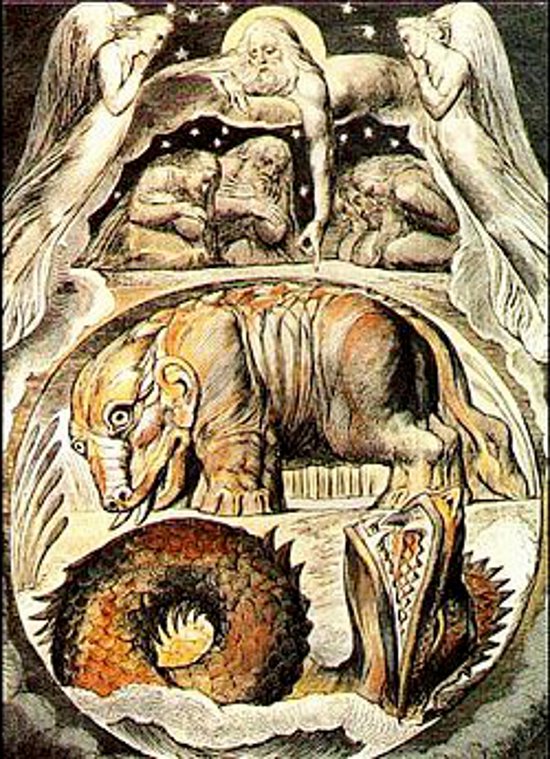

As the Washington Big Government Behemoth continues to grow – it needs to feed on you, the taxpayer.

An easy target is the Small Business Owner – Especially vulnerable if operating as a SOLE PROPRIETOR.

What follows is an excellent article reprinted here from the Washington Post:

IRS Targets Small Business Owners

IRS auditors targeting small business owners — but there are ways to protect your company

By J.D. Harrison

A new study used by the Internal Revenue Service to determine its auditing priorities shows small business owners in a handful of metropolitan areas are particularly likely to cheat Uncle Sam.

A new report suggests the IRS auditors may target small firms this year. (Susan Walsh – AP) Consequently, the agency may target small firms as it combs through tax filings this year, according to a report from the Associated Press.

An excerpt from the story:

Many of the communities identified by the study are very wealthy, including Beverly Hills and Newport Beach in California. Others are more middle class, such as New Carrollton, Md., a Washington suburb, and College Park, Ga., home to a section of Atlanta’s massive airport.

Steve Rosansky, president and CEO of the Newport Beach Chamber of Commerce, said business owners in his city are probably targeted because many have high incomes. The likelihood of an audit does increase with income, according to IRS data.

“I imagine it’s just a matter of them going where they think the money’s at,” Rosansky said in an interview. “I guess if I was running the IRS I’d probably do the same thing.”

The study was conducted by the National Taxpayer Advocate, an independent office within the IRS, using confidential information from inside the agency. The findings are meant to help auditors determine which cases are most likely to turn up additional tax revenue.

The results put particular scrutiny on sole proprietorships, whose owners do not report income the same way most individuals report their wages. As a result, experts say those business owners often have more opportunities to cheat the tax system.

High-income earners are also more likely to get hit with an audit, according to the data.

More from the AP story:

The study also looked at tax compliance in different industries, and found that people who own construction companies or real estate rental firms may be more likely to fudge their taxes than business owners in other fields.

So, what can you do to prepare for a second look by the IRS? John Nealon, the small business practice leader at Philadelphia-based accounting firm ParenteBeard, recently shared five pointers for small business owners to help alleviate audit anxiety.

Here are a couple of his suggestions:

• Map out mileage: It may make sense for a small business owner to lease or buy a car through their company to use primarily for work purposes. Remember any personal use of this vehicle, including commuting, is considered a fringe benefit by the IRS and is therefore subject to tax, so it’s important to keep clear records and have a consistent method for calculating personal use of a company car.

While using the car to travel on vacation would clearly be characterized as personal use, other situations are not be so cut and dry. Keeping track of mileage and documenting every trip will help support your claims should the IRS want to take a closer look.

• Don’t mix business and pleasure: Meals and entertainment are deductible items – sometimes. Depending on the circumstances, they may only be deductible up to 50 percent of the cost. The costs must also be kept within reason.

Extravagant spending on weekly “business” outings will raise eyebrows, so keep receipts for meals and entertainment and make sure you keep records of the exact purpose of all expenses.

SEE OUR SMALL BUSINESS LENDING SITE: Diversified Business Funding